| Profile | Service Excellence | Employees | Environmental Performance | Corporate Governance | ||

Profile

We are transforming the provision of integrated telecommunications services to enable millions of people to communicate with the world and with their worlds, and to access content, information and knowledge as a means for improving their quality of life.

G4-4, G4-6, G4-8

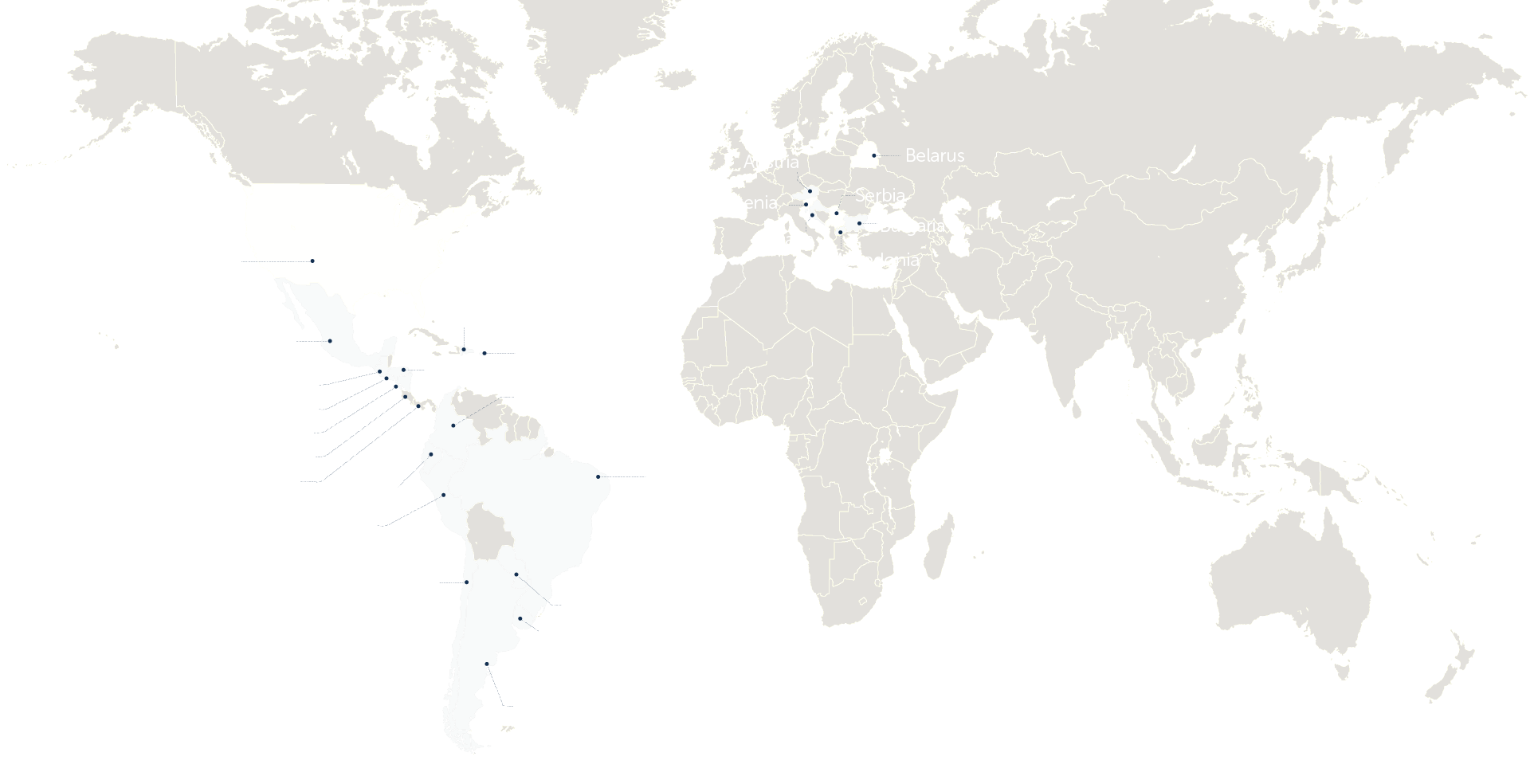

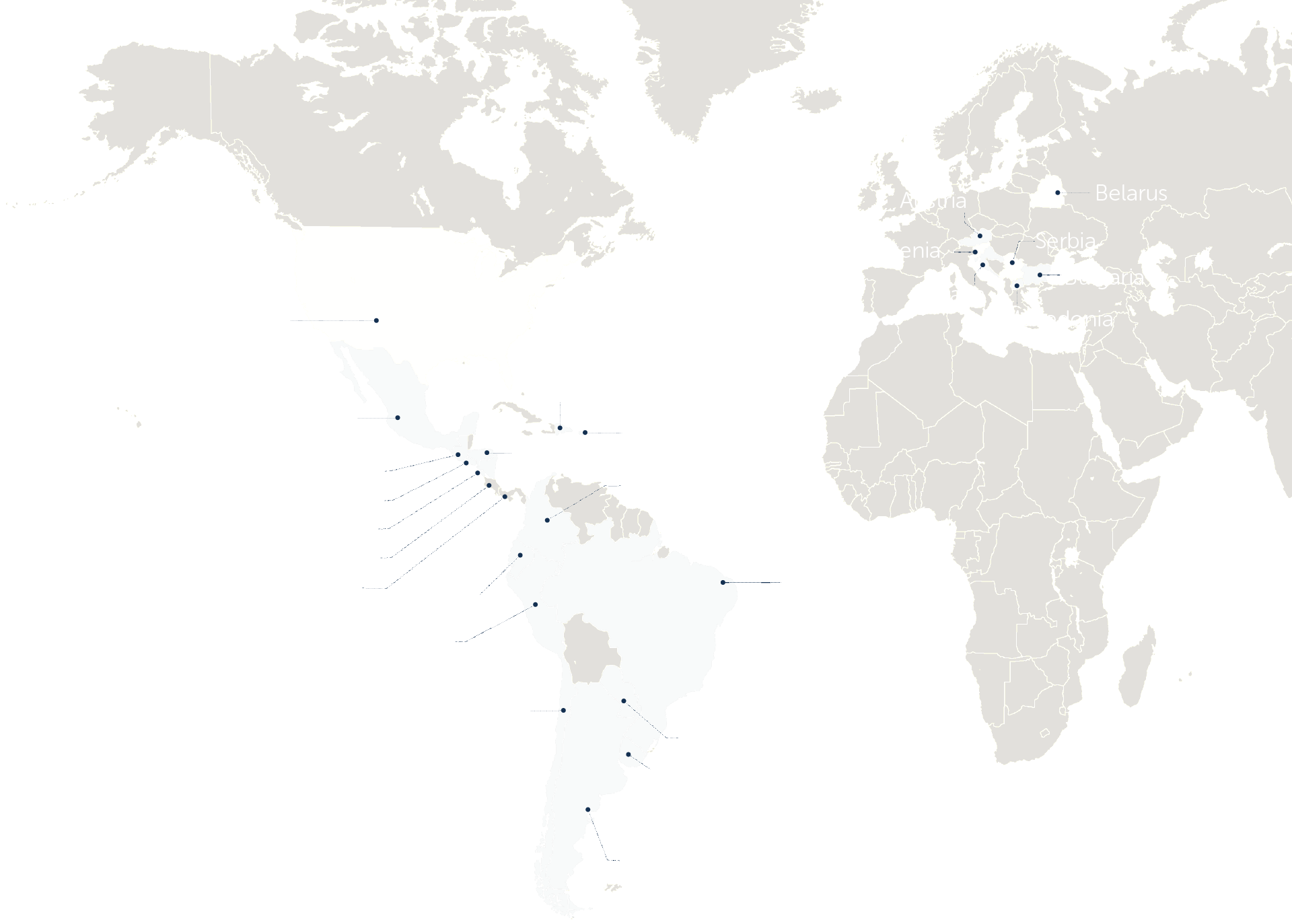

We are the leading provider of integrated mobile, fixed-line, broadband, and Pay TV services to millions of people in Mexico, Brazil, Central America and the Caribbean, United States, Peru, Colombia, Ecuador, Argentina, Paraguay, Uruguay, Chile, Austria, and Eastern Europe.

We offer our communications services under our proprietary brands Telcel, Telmex, Claro, Embratel, Net, TracFone, Straight Talk, A1, Velcom, Mobitel, Vipnet, Vip Operator, Vip Mobile, and Si.mobil.

Mobile services

Mobile services

Fixed-line services

Fixed-line services

Pay TV

Pay TV

Other

Other

(1) Equity participation held by Telmex Internacional, in which América Móvil holds a 97.86% interest.

(2) In November 2016, our fixed-line operations in Ecuador were merged into our mobile operations in that country.

(3) Includes our mobile, fixed-line, broadband, and Pay TV (including DTH) subscribers.

| Principal brands and services by country | |||||

| Country or region | Principal brands | Principal services | Equity participation | No. of access (thousands) |

Percentage of the operations (millions of access) |

| Mexico | Telcel |  |

100% | 95,131 | 26% |

| Telmex |  |

98.70% | |||

| Sección Amarilla(1) |  |

98.40% | |||

| Telvista |  |

89.40% | |||

| Brazil | Claro |  |

97.70% | 96,887 | 27% |

| Colombia | Claro |  |

99.40% | 35,258 | 9.70% |

| Telmex |  |

99.30% | |||

| United States | TracFone |  |

100% | 26,070 | 7% |

| Southern Cone | |||||

| Argentina | Claro |  |

100% | 32,319 | 8.89% |

| Telmex |  |

99.70% | |||

| Paraguay | Claro |  |

100% | ||

| Uruguay | Claro |  |

100% | ||

| Chile | Claro |  |

100% | ||

| Telmex(1) |  |

100% | |||

| Andean Region | |||||

| Peru | Claro |  |

100% | 22,621 | 6.22% |

| Ecuador | Claro(2) |  |

100% | ||

| Central America | |||||

| Costa Rica | Claro |  |

100% | 20,477 | 5.63% |

| El Salvador | Claro |  |

95.80% | ||

| Guatemala | Claro |  |

99.30% | ||

| Honduras | Claro |  |

100% | ||

| Nicaragua | Claro |  |

99.60% | ||

| Panama | Claro |  |

100% | ||

| Caribbean | |||||

| Puerto Rico | Claro |  |

100% | 8,116 | 2.23% |

| Dominican Republic | Claro |  |

100% | ||

| Austria & Eastern Europe | |||||

| Austria | A1 |  |

51% | 26,608 | 7.32% |

| Belarus | Velcom |  |

|||

| Bulgaria | Mobitel |  |

|||

| Croatia | Vipnet |  |

|||

| Slovenia | Si.mobil |  |

|||

| Macedonia | Vip Operator |  |

|||

| Serbia | Vip mobile |  |

|||

| The Netherlands | Kpn |  |

21.10% | - | - |

| Total | 363,487 | 100% | |||

Company presence

Argentina

Argentina

Austria

Austria

Belarus

Belarus

Brazil

Brazil

Bulgaria

Bulgaria

Chile

Chile

Colombia

Colombia

Costa Rica

Costa Rica

Croatia

Croatia

Dominican Republic

Dominican Republic

Ecuador

Ecuador

El Salvador

El Salvador

Guatemala

Guatemala

Honduras

Honduras

Macedonia

Macedonia

Mexico

Mexico

Nicaragua

Nicaragua

Panama

Panama

Paraguay

Paraguay

Peru

Peru

Puerto Rico

Puerto Rico

Serbia

Serbia

Slovenia

Slovenia

United States

United States

Uruguay

Uruguay

62% of our base stations are equipped with 3G and 4G technologies.

G4-EC7

We are transforming our operations to preserve our position of leadership and to continue to provide our customers with the best telecommunications experience in the market. To achieve this transformation, we make ongoing investments in the improvement and upgrading of our infrastructure.

We are transforming our internal operations through the implementation of technological changes in our networks, IT systems, and processes, in order to deliver the best customer experience, offer new products, and service new markets.

The investment plan for 2016 was of 155,024 million pesos1, in upgrades to our infrastructure and in the development of new projects.

One of our most significant infrastructure development projects is the upgrade of our base stations through Single RAN.

1 CAPEX.

Benefits of the base stations upgrade:

2 This is the expected reduction upon the project is 100% completed.

We launched this project in 2014, and it is expected to be completed in 2018. As of the end of 2016, the percentage of completion stood at 46%. SingleRAN allows base stations to be reconfigured remotely as new technologies are developed, thus eliminating the need for individual, on-site upgrades, which translates into cost and time efficiencies.

While evolving towards an enhanced service, we have used servers designed to take into account performance, availability, scalability, flexibility, cost factors, and redundant, resilient networks with sufficient capacity to accommodate unexpected surges in demand, all of which are capable of supporting large volumes of data in real time.

The above has had a positive impact on our revenues, customers’ experience, CAPEX, OPEX, quality and efficiency.

In addition, since 2014 we provide international connectivity through our submarine cable to the subsidiaries in the United States3, Central and South America with more than 168 thousand km of submarine cable, which includes the AMX-1 system of 17,500 km length with 12 landing points.

3 In the United States, we do not own any mobile telecommunications facilities or hold any mobile spectrum licenses. Instead, we purchase airtime through agreements with mobile service providers and resell airtime to customers.

This cable has the capacity for the transmission of 85 terabits per second, of which only two terabits are currently being used. When operating at full capacity, the cable is able to process 846 million calls simultaneously, and to transfer 53 million images per second and download 2.2 million songs per second.

Our Vision

To be the fastest-growing telecommunications company and preserve our leadership in the telecommunications industry.

As support to our complex infrastructure, we have a Satellite Fleet operated by Star One, constituting the largest satellite network in Latin America.

In December 2016, we launched the Star One D1 satellite to replace the Star One B4 satellite, which had reached the end of its useful life. The Star One D1 satellite, which has life expectancy of 15 years, supplies capacity in Mexico, and Central and South America. When operating at full capacity, it has the ability to broadcast 1,300 standard or 780 high definition channels, and 2 million songs, simultaneously. With the deployment of this satellite, we increased the size of our operating satellite fleet to a total of nine, and strengthened our commitment to providing to our customers the best telecommunication experience.

We also own and operate 21 data centers located in nine countries (including 18 in Latin America, and 3 in Austria), which have an aggregate area of 31 thousand square meters, which we use to manage a number of cloud solutions.

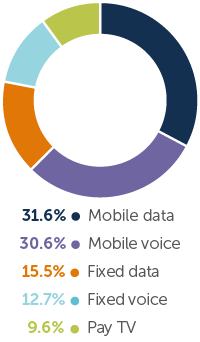

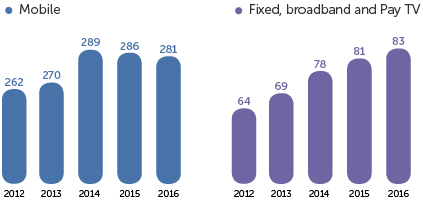

G4-9, G4-56, G4-EC1

We seek to maximize our economic performance in order to offer to our customers and strategic partners the security of a stable organization while creating value for our shareholders and investors.

To that end, we make ongoing investments in infrastructure, incorporate innovative, more efficient internal processes throughout our organization, and address those aspects of our operations that are material to our stakeholders.

Data Centers by country

As of December 31, 2016, we had:

4 RGUs: Revenue Generating Units, which include our mobile, fixed-line, broadband, and Pay TV subscribers.

To that same end, and in that same conviction, we endeavor to offer a broad range of telecommunications services that are at the forefront of global trends, in order to address the communications needs of our customers. We are also engaged in significant efforts to build a sustainable organization that focuses not only on generating economic value, but also on procuring benefits for society and for the environment.

As in prior years, our operating results for 2016 were a reflection of the ambitious goals that we set out to achieve at the beginning of the year.

| Economic Performance 2016 |

| Direct Economic Value Generated (EVG) |

| $979,605,083 |

| Economic Value Distributed (EVD) |

| $579,636,043 |

| Economic Value Retained (EVG-EVD) |

| $399,969,040 |

Thousands of Mexican pesos.

EVG = Operating revenues + interest income.

EVD = Operating costs + other expenses + income tax expense + interest expense + dividends paid.

Highlights

+727,000 km of fiber-optic cable

196,159 base stations

85 terabits per second of transmission capacity through our submarine cable system

21 data centers

9 satellites

| Institutional goals | |||

|---|---|---|---|

Customer satisfaction |

|

||

Growth |

|

||

Leadership |

|

||

Profitability |

|

||

| * Index that measures the difference between the number of subscribers who are willing to recommend our services, and those who are not | |||